iowa homestead tax credit linn county

Calendar Courts Elections Employment FAQ. Adopted and Filed Rules.

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

View a list of credits and exemptions prepared by the Boone County assessor including the Homestead Tax Credit and more.

. M-F 800 am - 500 pm Voice. Linn County Assessor 935 2nd St SW Cedar Rapids IA 52404 Hours. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate.

The current credit is equal to the actual tax levy on the first 4850 of actual value. Any Property Owner In The State Of Iowa Who Lives In The Property Can Receive A Homestead Tax Credit. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Part of the homestead tax credit in the iowa code. Iowa Tax Reform. Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa.

Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. That amount may then be reduced by. Upon the filing and allowance of the claim the claim is allowed on that.

How the Homestead Exemption Works. 2015 governor branstad signed in to law house file 166 an act relating to the disabled veteran homestead tax. What is the Credit.

In the state of Iowa this portion is the first 4850 of your propertys net taxable value. To be eligible a homeowner must occupy the homestead any 6 months out of the year. This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed.

Homestead Tax Credit Application 54-028. When it comes to the homestead exemption its up to you to. Linn county has one.

In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must. Report Fraud.

Linn County Oregon Fha Va And Usda Home Loan Information Fhlc

Patch Program Cedar Valley Habitat For Humanity

Pre Linn County Fair And Rodeo Special Section By Ckt4 Issuu

Iowa Farmers Getting Squeezed Out By Land Preservation Tax Credits Farm Bureau Says

The Project Gutenberg Ebook Of History Of Linn County Iowa By Luther A Brewer And Barthinius L Wick

Assessor Linn County Ia Official Website

Calculating Property Taxes Iowa Tax And Tags

/cloudfront-us-east-1.images.arcpublishing.com/gray/MLZMZJ5Q4BAEXCULAXF223FLBA.jpg)

Property Tax Reminder From Linn County And Payment Options

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Linn County Property Tax Statements Being Mailed Payments Due September 30 Kgan

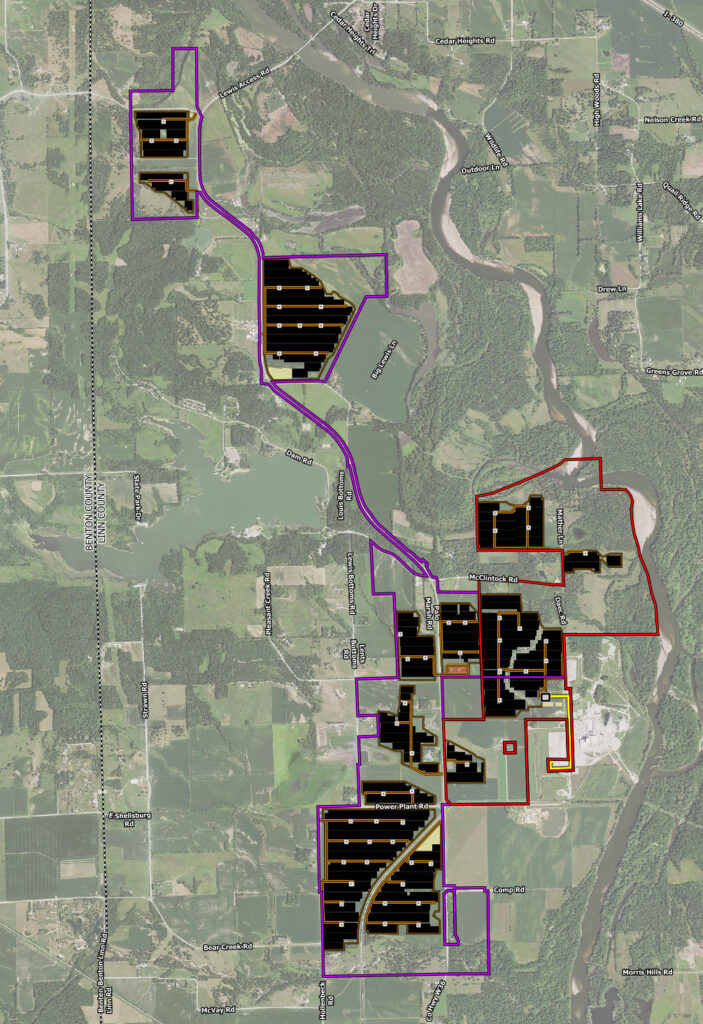

Nextera Files Applications With Linn County For Duane Arnold Solar Projects

Everyday Elements Of Landscapes Matter Iowa Landowner Options

Linn County Iowa Still In Business View Magazine

Navigator Co2 Pipeline Would Drop Linn County From New Proposed Route The Gazette